The Growing Data Center Industry: What it is and Its Future Potential

In today's digital age, data is the backbone of most businesses and organizations. Whether it's for cloud computing, e-commerce, or artificial intelligence, data needs to be securely stored, processed, and accessed around the clock. This is where data centers come in. But what exactly are data centers, and how is the industry evolving to meet the needs of an increasingly digital world?

What is a Data Center?

A data center is a physical facility that houses critical

IT infrastructure such as servers, storage systems, and networking equipment.

These facilities are designed to manage, store, and process vast amounts of

data. Essentially, data centers enable the digital services we rely on every

day—from cloud services like Google Drive and Amazon Web Services to social

media platforms and enterprise software.

Data centers are crucial for providing businesses with

the infrastructure they need to store and process information. They support

data-driven technologies, such as artificial intelligence (AI), machine

learning (ML), the Internet of Things (IoT), and big data analytics. As more

companies transition to digital operations, the demand for these data centers

has never been higher.

Detailed Analysis of Data Center Stocks in India

1. ABB India (ABB)

- About

the Company: ABB India, a subsidiary of ABB Group, is a global leader

in electrification, automation, and digital technologies, offering power

transmission, industrial automation, and building solutions, including

data center systems for power distribution, cooling, and automation.

- Key

Points and Business Segments: Includes power transmission and

distribution (high-voltage and medium-voltage products), industrial

automation, building and infrastructure solutions, and data center

solutions.

- Global

Presence and Geographical Revenue Split: Operates in over 100

countries, with significant Asia Pacific revenue contribution.

- Manufacturing

Facilities: Facilities in Nashik, Vadodara, and Chennai, producing

various products for industries.

- Order

Book: Robust, indicating strong demand for products and services.

- Clientele:

Major industries, utilities, and infrastructure projects across India and

internationally.

- Future

Plans or Potential: Focus on digital transformation (smart grids,

IIoT), sustainability (reducing carbon footprint), and data center growth.

- Pros:

Strong global brand, diversified segments, innovation focus.

- Cons:

Exposure to economic fluctuations, intense competition.

- Why

I Buy This Stock: Strong parentage, diverse portfolio, and data center

involvement make it attractive, especially with growing demand.

2. Amber Enterprises India (AMBER)

- About

the Company: A leading solution provider for air conditioners and

components, manufacturing RACs and parts like heat exchangers, used

indirectly in data center cooling.

- Key

Points and Business Segments: Focus on air conditioners, components

(heat exchangers, motors), and diversification into washing machines.

- Global

Presence and Geographical Revenue Split: Primarily India, with some

exports.

- Manufacturing

Facilities: 15 facilities across nine locations in India, highly

integrated.

- Order

Book: Strong from consumer durable companies, potentially benefiting

data center cooling demand.

- Clientele:

Major RAC brands like LG, Whirlpool, which may supply to data centers.

- Future

Plans or Potential: Expansion in consumer durables, innovation in

product efficiency, and indirect growth from data center cooling needs.

- Pros:

Dominant in RAC components, backward integration, potential cooling demand

growth.

- Cons:

Cyclical consumer market, intense competition.

- Why

I Buy This Stock: Products crucial for data center cooling, positioned

to benefit from increased demand as data centers expand.

3. Anant Raj (ANANTRAJ)

- About

the Company: A real estate developer focusing on townships, IT parks,

hotels, and data centers via Anant Raj Cloud, with operations in Manesar,

Rai, and Panchkula.

- Key

Points and Business Segments: Real estate development, data center

operations (targeting 300 MW), and hospitality.

- Global

Presence and Geographical Revenue Split: Primarily India, with data

centers in Delhi NCR and other regions.

- Manufacturing

Facilities: Focuses on real estate and data center operations, not

manufacturing.

- Order

Book: Robust pipeline for real estate and data center projects.

- Clientele:

Corporate entities, government, technology companies for data centers.

- Future

Plans or Potential: Expanding data center capacity, partnership with

Google for cloud services, continued real estate development.

- Pros:

Diversified portfolio, strong Delhi NCR presence, Google partnership.

- Cons:

High capital for data centers, real estate regulatory challenges.

- Why

I Buy This Stock: Entry into data centers with Google partnership,

high growth potential in a growing market.

4. Aurionpro Solutions (AURIONPRO)

- About

the Company: Provides advanced technology solutions for banking,

mobility, payments, and government, including data center design,

construction, and management.

- Key

Points and Business Segments: Banking transformation,

mobility/payments, government solutions, and data center services.

- Global

Presence and Geographical Revenue Split: India, expanding to Europe

and other markets.

- Manufacturing

Facilities: Primarily software/services, may have data centers but not

traditional manufacturing.

- Order

Book: Strong, with recent data center wins from hyperscale players.

- Clientele:

Banks, government agencies, corporations in India and abroad.

- Future

Plans or Potential: Data center expansion, international growth via

acquisitions, AI and ML investment.

- Pros:

Diversified high-growth segments, project delivery track record, global

expansion.

- Cons:

Dependence on key clients, IT services competition.

- Why

I Buy This Stock: Strategic data center focus, recent wins, and global

expansion make it promising.

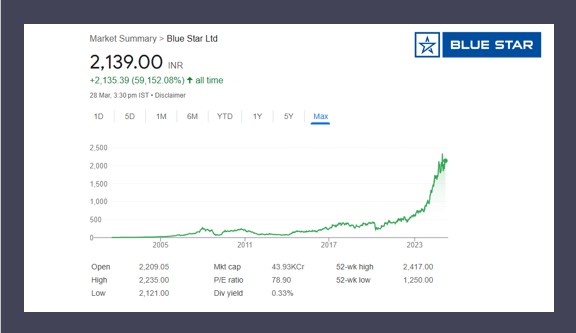

5. Blue Star (BLUESTARCO)

- About

the Company: Manufactures air conditioners, refrigeration products,

and provides MEP services, with EMPG focusing on data center projects.

- Key

Points and Business Segments: Consumer products (ACs, refrigeration),

EMPG (MEP for data centers), and services.

- Global

Presence and Geographical Revenue Split: Primarily India, some Middle

East projects.

- Manufacturing

Facilities: Facilities in Thane, Bharuch, Dadra, Himachal Pradesh for

ACs and refrigeration.

- Order

Book: Robust for MEP services, including data centers.

- Clientele:

Corporations, government, institutions, including data center operators.

- Future

Plans or Potential: Data center services expansion, energy-efficient

innovations, digital transformation.

- Pros:

Strong brand, MEP track record, sustainability focus.

- Cons:

Seasonal consumer sales, competitive market.

- Why

I Buy This Stock: MEP services for data centers align with growing

demand, focus on efficiency makes it promising.

6. Cummins India (CUMMINSIND)

- About

the Company: Manufactures diesel and natural gas engines, power

generation products, crucial for data center backup power, subsidiary of

Cummins Inc.

- Key

Points and Business Segments: Engine business, power systems

(generator sets for data centers), distribution.

- Global

Presence and Geographical Revenue Split: Primarily India, exports,

part of global Cummins network in 190+ countries.

- Manufacturing

Facilities: Facilities in Pune, Phaltan, Dewas for engines and

generator sets.

- Order

Book: Strong, driven by data center backup power demand.

- Clientele:

Industries, construction, data center operators.

- Future

Plans or Potential: Sustainable power solutions, data center market

growth, digital transformation.

- Pros:

Strong parentage, diversified portfolio, sustainability focus.

- Cons:

Cyclical automotive/construction sectors, emission regulations.

- Why

I Buy This Stock: Generator sets essential for data centers, high

demand, aligns with sustainability trends.

7. Hitachi Energy (POWERINDIA)

- About

the Company: Provides power transmission and distribution solutions,

part of Hitachi Energy, offering data center electrification solutions.

- Key

Points and Business Segments: Power transmission, distribution, data

center energy solutions.

- Global

Presence and Geographical Revenue Split: Over 40 countries, India

serves domestic and exports.

- Manufacturing

Facilities: Facilities in Nashik, Vadodara, Mumbai for power products.

- Order

Book: Strong, driven by power infrastructure and data center projects.

- Clientele:

Utilities, industries, data center operators.

- Future

Plans or Potential: Digital grid management, sustainability, data

center electrification expansion.

- Pros:

Global leader, diversified portfolio, data center focus.

- Cons:

Regulatory changes, competition.

- Why

I Buy This Stock: Energy solutions for data centers, global backing,

sustainability focus attractive.

8. Kalpataru Projects International (KPIL)

- About

the Company: Leading EPC company in power, railways, civil

infrastructure, and data centers, with global operations.

- Key

Points and Business Segments: Power transmission, railways,

civil/buildings (including data centers), data center construction.

- Global

Presence and Geographical Revenue Split: Over 70 countries, Africa,

Asia, Middle East, Americas.

- Manufacturing

Facilities: Capabilities for transmission towers, hardware, primarily

EPC focused.

- Order

Book: Significant, with recent data center wins.

- Clientele:

Government, utilities, corporations, data center operators.

- Future

Plans or Potential: Data center portfolio expansion, international

growth, renewable energy exploration.

- Pros:

EPC track record, diversified segments, data center growth.

- Cons:

High capital needs, geopolitical risks.

- Why

I Buy This Stock: Data center construction expertise, global presence,

growth opportunities.

9. KEC International (KEC)

- About

the Company: EPC company specializing in power, railways, civil, and

cables, with data center construction and supply.

- Key

Points and Business Segments: Power transmission, railways,

civil/buildings (data centers), cable manufacturing.

- Global

Presence and Geographical Revenue Split: Over 60 countries, Africa,

Asia, Middle East, Americas.

- Manufacturing

Facilities: Facilities for towers, hardware, cables in India.

- Order

Book: Robust, with data center construction and cable wins.

- Clientele:

Government, utilities, corporations, data center operators.

- Future

Plans or Potential: Data center focus, international expansion,

digital technology investment.

- Pros:

EPC track record, diversified, data center and cable supply growth.

- Cons:

High capital, currency/geopolitical risks.

- Why

I Buy This Stock: Dual role in data center construction and cables,

global presence, growth potential.

10. Kirloskar Oil (KIRLOSENG)

- About

the Company: Manufactures diesel engines and generator sets, providing

backup power solutions for data centers.

- Key

Points and Business Segments: Diesel engines, generator sets (data

center backup), after-sales service.

- Global

Presence and Geographical Revenue Split: Over 50 countries,

significant exports.

- Manufacturing

Facilities: Facilities in Pune, Nashik, Ahmedabad for engines and

generator sets.

- Order

Book: Steady, driven by data center backup power demand.

- Clientele:

Farmers, industries, institutions, data center operators.

- Future

Plans or Potential: Renewable energy exploration, digital

transformation, data center market focus.

- Pros:

Established brand, diversified portfolio, backup power demand.

- Cons:

Agricultural dependency, competition.

- Why

I Buy This Stock: Generator sets crucial for data centers, high

demand, innovation focus promising.

11. Railtel Corp of India (RAILTEL)

- About

the Company: Telecom infrastructure provider owned by Indian Railways,

operates two Tier-3 data centers for colocation, hosting, and cloud

services.

- Key

Points and Business Segments: Telecom services, data center services

(Secunderabad, Gurgaon), NLD services.

- Global

Presence and Geographical Revenue Split: Primarily India, pan-India

network.

- Manufacturing

Facilities: Focus on network operations, no manufacturing.

- Order

Book: Strong from government, private clients for telecom and data

centers.

- Clientele:

Government, banks, institutions, corporations.

- Future

Plans or Potential: Data center capacity expansion, digital

transformation, tech partnerships.

- Pros:

Government backing, extensive network, Tier-3 data centers.

- Cons:

PSU regulatory constraints, competition from private players.

- Why I Buy This Stock: Strategic data center services, pan-India network, growth in digital economy.

Conclusion

As the data center industry in India grows rapidly due to

digital transformation, cloud computing, and AI, these companies are

well-positioned to capitalize on the increasing demand. Whether through

providing power solutions, backup systems, construction services, or cooling

solutions, these companies are integral to the data center ecosystem. Investing

in these businesses can be a smart choice as they continue to expand and

support the growing digital infrastructure in India.

Disclaimer:

The information provided in this article is for general informational purposes only. While every effort has been made to ensure the accuracy and reliability of the content, the author and publisher do not guarantee the completeness, accuracy, or usefulness of the information. The article does not constitute financial, investment, or professional advice, and readers are encouraged to conduct their own research or consult with relevant experts before making any decisions based on the information provided.

The data center industry, like any sector, may be subject to changes, trends, and factors that could impact its future growth. The views and opinions expressed are those of the author and may not reflect the views of any organization or entity.

The author and publisher are not responsible for any loss or damage arising from the use of this article or the reliance on any information contained herein.

0 Comments